Discover the Best Periods When to Make Money

Ever feel like the stock market’s just a wild guessing game? Think about this: Back in the 1800s, a farmer gets wiped out in a brutal crash, then sketches out a chart that seems to predict booms and busts for centuries. That’s the periods when to make money chart, and it’s got folks buzzing even now. It breaks down the best periods when to make money by spotting those hidden rhythms in the economy.

With everything flipping upside down these days, getting a grip on these cycles could be your edge. Sure, some call it ancient history, but the proof’s in the pudding—it called shots on some huge events. Let’s unpack this thing and see if it fits your playbook.

Who Came Up With the Periods When to Make Money Chart?

Meet Samuel Benner, an Ohio farmer who hit rock bottom in the Panic of 1873. That mess cleaned him out, but he didn’t quit. He dug into old price records for stuff like pig iron, corn, and hogs, and noticed these weird repeating loops. He even linked some to things like sunspots messing with harvests.

Benner poured it all into his book, Benner’s Prophecies of Future Ups and Downs in Prices. His chart maps out from the 1780s clear to 2059. People still pull it out today because it turns messy markets into straightforward stages. Picture him as a pioneer crunching numbers the old-school way, all to help you decide when to jump in or bail out.

Digging Into the Cycles of the When to Make Money Chart

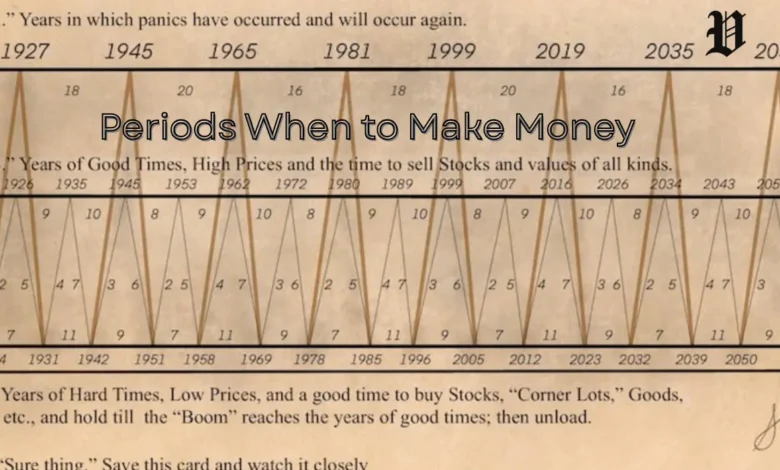

The when to make money chart splits things into three main vibes: panic years, good times, and hard times. Each one clues you in on what to do next. Panic years are when everything goes haywire—prices tank or spike for no good reason. Good times mean sky-high values, so that’s your cue to sell. Hard times? That’s bargain-hunting season, buy low and wait for the turnaround.

Benner pinned down the beats behind these. Panics hit on a 16-18-20 year groove. Booms dance to 8-9-10 years. Slumps follow 11-9-7 years. They all tie into a big 54-year wave. This isn’t pulled from thin air; it’s rooted in real price trends he tracked.

Here’s how the chart lays it out, year by year:

Panic Years (Line A): Chaos hits in spots like 1819, 1837, 1857, 1873, 1891, 1929 (close to his 1927 call), 2008 (near 2007), and watch for 2026-2032.

Good Times (Line B): Peak selling windows, think 1926, 1935, 1945, 1953, 1962, 1972, 1980, 1989, 1999, 2007, 2016, and 2026.

Hard Times (Line C): Prime buying dips, such as 1924, 1931, 1942, 1951, 1958, 1969, 1978, 1985, 1996, 2005, 2012, 2023, and 2032.

These rhythms let you see turns coming. Like, after a freak-out, good vibes might stick around for seven years, then slide into 11 years of meh before nine years of climbing back up.

| Cycle Type | Pattern (Years) | What It Means for You |

| Panic | 16-18-20 | Hang tight; markets get nuts. Brace for drops or bubbles. |

| Prosperity | 8-9-10 | Cash out high; everything’s pumping. |

| Depression | 11-9-7 | Scoop up deals; stuff’s cheap and poised to bounce. |

| Overall | 54 (combined) | Big-picture planning; matches those long economic swells. |

This setup makes the periods when to make money chart super handy. You time your moves, but mix in today’s news for the full picture.

People also see: Exploring the Highest Paying Trade Jobs in 2025

Looking Back: How Spot-On Has This Chart Been?

Doubters say it’s dusty and done, but man, its wins are hard to ignore. It nailed the 1929 crash, just off by a couple years (said 1927). The 2000 tech wreck lined up, and 2008’s meltdown hit right after a predicted peak. Even the 2020 pandemic plunge fit the panic mold.

Running the numbers over 150 years shows hits and misses. From 1925 to 2023 in the S&P 500, “good” stretches averaged 16.62% yearly gains with less drama. The rough patches still gave 7.19%, but with more bumps. Solid, but it means ditching the market entirely could cost you.

Some calls were bang-on. Benner lived through 1873’s mess, so that one’s exact. It flagged 1981’s shakes and 1999’s top before the 2000 flop. Flubs happen too, like calling downers in 1985 or 2019 when things actually perked up.

Right now in 2025, it’s signaling a shift. Good times from 2023 to 2026 mean bullish vibes for a bit. But heads up for tougher spots by 2032. It gets regimes right about 90% of the time, though dates might slip a year or two.

Everyday Stories: Putting Periods When to Make Money to Work

Say you’re eyeing stocks in 2007. The periods when to make money screams peak good times. You offload at the top, skipping the 2008 nosedive—S&P tanked over 50%. Jump to 2020’s lows: You snag deals in hard times, and boom, 2021’s rebound pays off.

Benner connected dots to real life. Sun cycles tweak crops, bumping corn prices every 11 years, which echoes across the economy. Pig iron, big for factories, dips every 7-11 years. Today, you see echoes in tech surges or energy flips.

For raw goods, this chart’s gold. Grab gold or oil in slumps when no one’s buying. Dump in highs when everyone’s chasing. Old-timers like farmers timed hog sales around it, dodging price pits.

Fitting the When to Make Money Chart Into Your Game Plan

Grab the chart and layer it over your stuff. If it’s good times like today in 2025, maybe shave off some wins. In the dumps, stack up stocks or property on the cheap. But don’t go all-in blind; weave in fresh stats or hedges.

Quick steps to roll with it:

Snag a copy of the periods when to make money chart for your desk.

Pinpoint where 2025 sits and what’s next.

Match it to your guts—bold types might bet against panics.

Test it on your past picks to tweak.

Keep an eye out for curveballs, like wars or bugs throwing off the beat.

This makes the chart your sidekick. You ditch the guesswork, make smarter calls, and sleep better.

The Catch: Why This Chart Isn’t Magic

Times change. Benner’s world had no Fed pulling strings, no worldwide supply chains, no AI shaking things up. Stuff like rate hikes or robot revolutions can bulldoze old patterns. It’s ace at vibe checks—bull or bear—but stumbles on pinpoint days.

Naysayers point out it lags behind just holding steady. Over those 99 years, parking your cash outperforms jumping around, since even bad runs turn profit. Treat it like a mood ring, not a fortune teller. In 2025, with debts piling and prices jumping, it hints at bumps ahead, but double-check with now’s facts.

It’s like checking the forecast before a hike. It warns of rain, but you still peek out the window. Mix it with spreading your bets for the win.

See More: Exploring the Consumer Services Field in DepthFAQ

What is the periods when to make money chart?

It’s a classic market cycle map from Samuel Benner back in 1875. It highlights phases like panics, good times, and hard times to steer your buy-sell choices.

Who created the when to make money chart?

Samuel Benner, that Ohio farmer hammered by the 1873 panic, built it from scratching through commodity price histories.

How does the periods when to make money work?

It rides on looping cycles: 16-18-20 years for panics, 8-9-10 for booms, and 11-9-7 for dips. These forecast the economy’s highs and lows.

Is the periods when to make money chart accurate?

It’s called big ones like 1929 and 2008, sometimes spot-on, sometimes a year off. Tests show it nails market moods but won’t always top long-haul holding.

What does the when to make money chart say for 2025?

For 2025, it shows good times stretching from 2023-2026, pointing to high values and maybe time to sell before things cool off.

How can I use the periods when to make money chart today?

Layer it on your portfolio. Snap up in hard times, unload in good ones, tread light in panics. Boost it with current insights for solid plays.

What are the main cycles in the periods when to make money?

Core ones are panics every 16-18-20 years, good times in 8-9-10 patterns, hard times every 11-9-7, all wrapping into a 54-year flow.

Has the when to make money chart predicted recent crashes?

Yep, it synced with 2000’s bubble burst, 2008’s crisis, and 2020’s COVID hit, often close enough on the calendar.

What limitations does the periods when to make money chart have?

Rooted in 1800s info, it misses today’s twists like central banks or global shakes. Bad phases still often make money, so don’t over-rely.

Where can I find the periods when to make money chart?

Hunt for Benner Cycle pics in investor spots or books. Plenty of updated takes floating around online.